ManneFin Loan -- Our new app

ManneFin Loan is a trusted digital lending platform operated by Manne Fintech Private Limited, providing quick, secure, and convenient personal loans to eligible individuals across India.

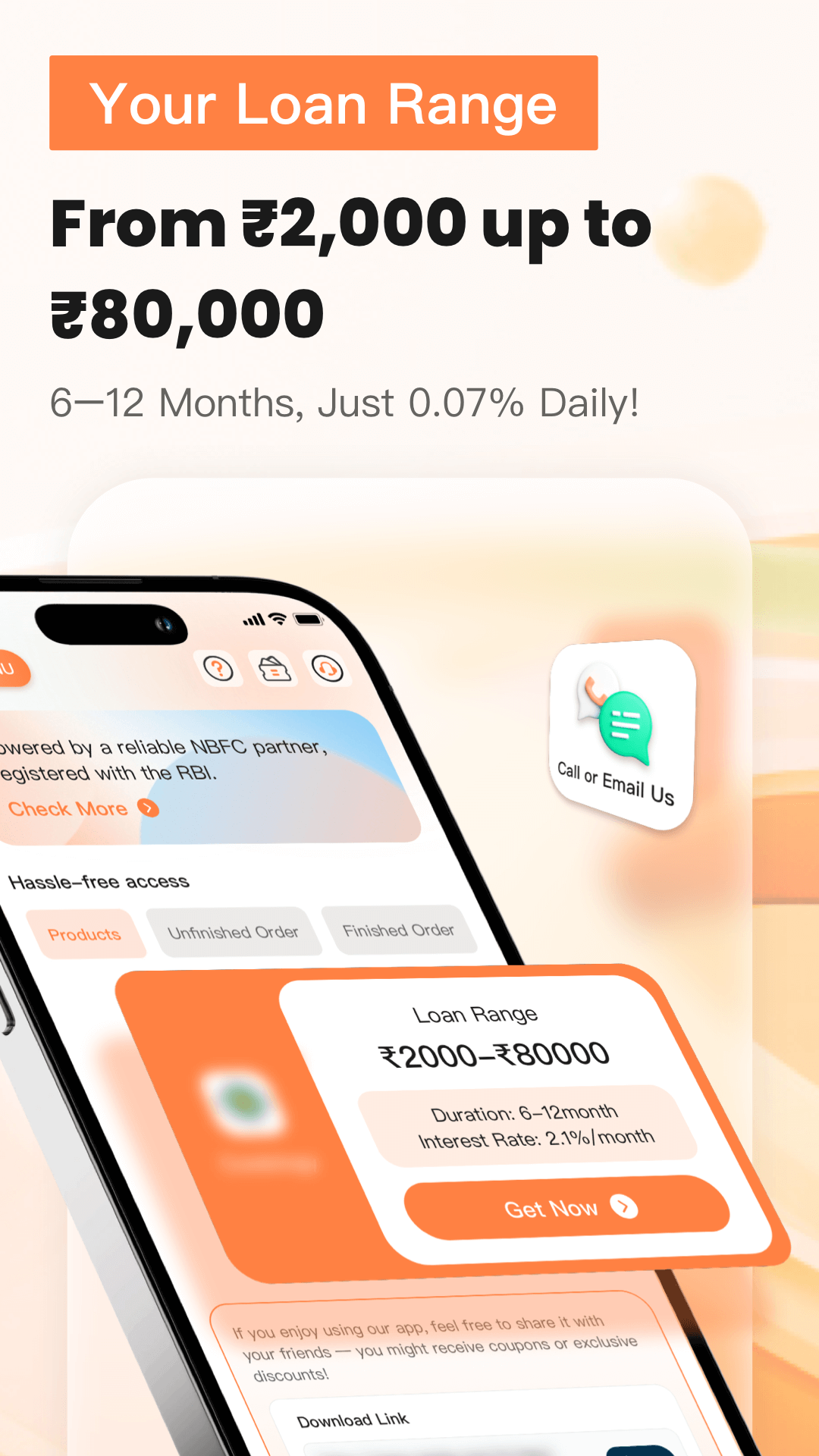

All loans offered through the ManneFin Loan app are issued by our official lending partner, INTLOW LEASING AND FINANCE PRIVATE LIMITED, a registered Non-Banking Financial Company (NBFC) regulated by the Reserve Bank of India (RBI). This partnership ensures full regulatory compliance and responsible financial practices.

Example Calculation

For a loan of ₹10,000 over 12 months:

Service Fee: ₹10,000 * 3% = ₹300

Amount Disbursed: ₹10,000 - ₹300 = ₹9,700

Monthly Interest: ₹10,000 * 2.1% = ₹210

Total Repayment: ₹210 * 12 + ₹10,000 = ₹12,520

APR: 25.2%